child tax credit payment for december 2021

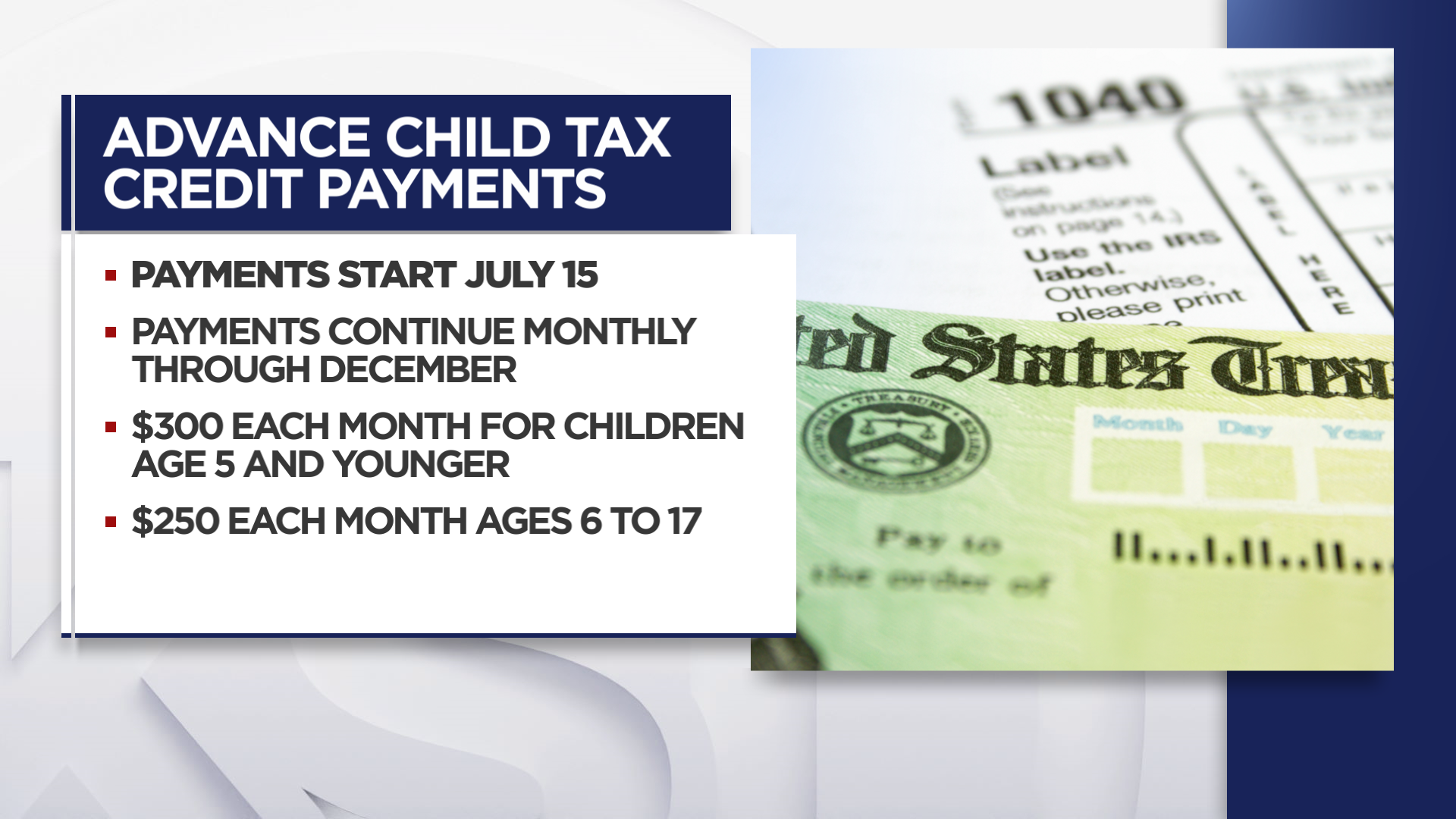

The full child tax credit is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month. The IRS plans to begin sending monthly payments from the new 3000 child tax credit in July Commissioner Charles Rettig said Tuesday during a hearing with the Senate.

What Is The Child Tax Credit Tax Policy Center

If the IRS says the December 2021 child tax credit payment has been made but the money doesnt show up there is a way to trace it.

. About 2 of CTC families didnt get the payment at first and then received more than the correct payment. Those who are not eligible for the. Increases the tax credit amount.

6WDWH 7RWDO 1XPEHU RI 3DPHQWV. The 2021 CTC is different than before in 6 key ways. Claim the full Child Tax Credit on the 2021 tax return.

The IRS and US. The sixth Child Tax Credit payment kept 37 million children from poverty in December. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Children draw on top of a Treasury check prop during a rally in front of the US. Department of the Treasury. December 15 2021.

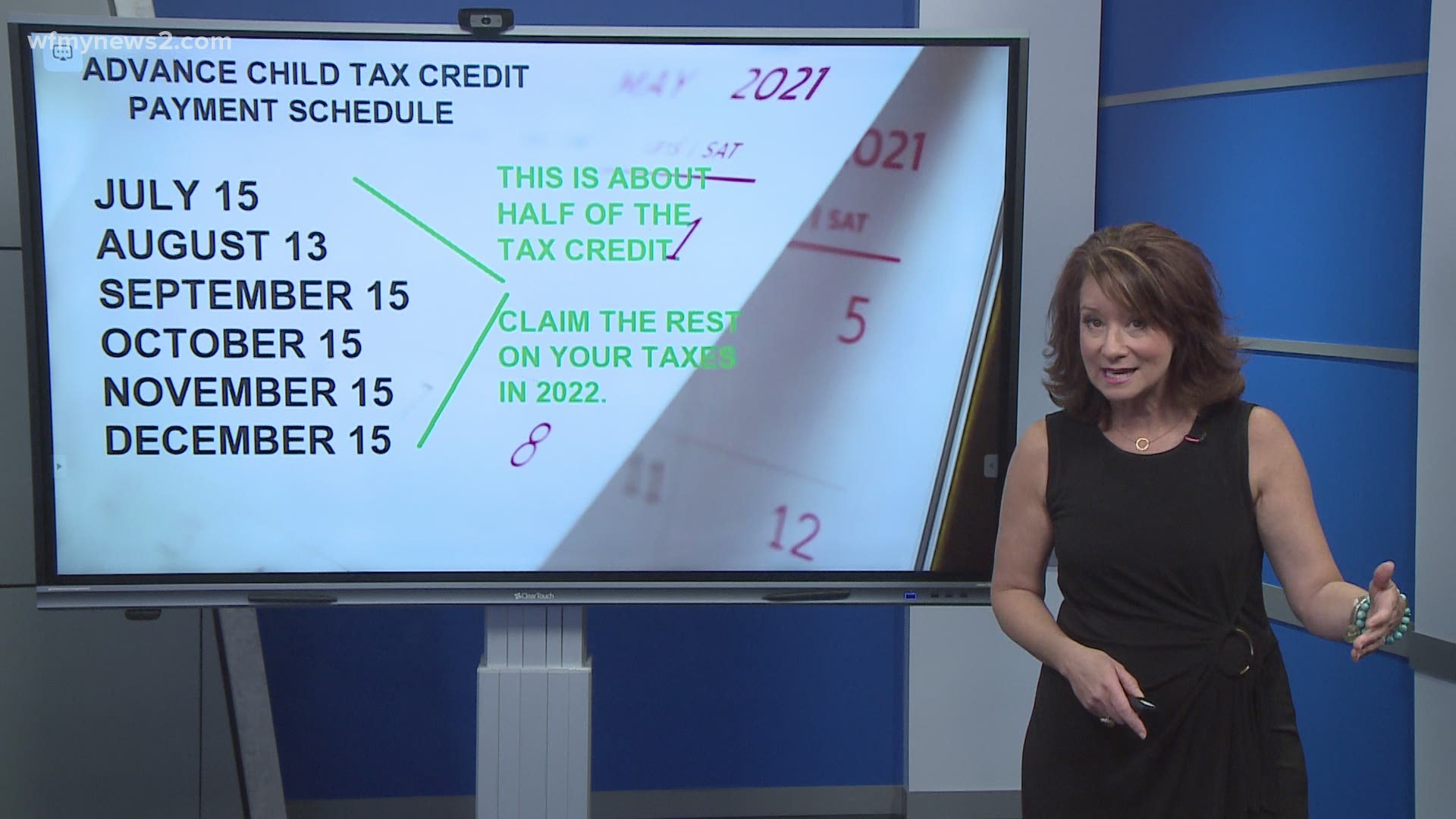

The full child tax credit for 2021 is 3600 per child up to age 6 or 300 a month and 3000 per child ages 6 to 17 or 250 per month. In absence of a January payment though the monthly child poverty rate could. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

The remaining credit can be claimed on. This means that the total advance payment amount will be made in one December payment. The tax credits maximum amount is 3000 per child and 3600 for children under 6.

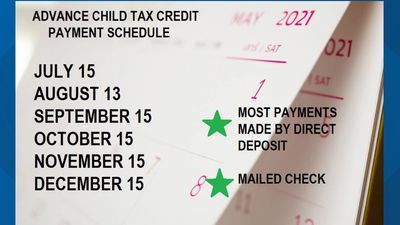

Advance Child Tax Credit Payments Distributed in December 2021. Since July the Child Tax Credit previously a once-a-year credit has been sent out in the form of a direct payment worth up to 300 per month for eligible families. In absence of a January payment though the monthly child poverty rate could potentially increase from 121 percent to at least 171 percent in early 2022the highest.

15 July Age of Child in 2021 Monthly Payment July-December 2021 Lump-Sum Payment. Rather than making people pay it back the IRS decided to reduce. To unenroll from advance payments use the IRS Child Tax Credit Update Portal at irsgov.

While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of. ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. For each qualifying child age 5 and younger up to 1800 half the total.

2 days agoENHANCED federal child tax credits lapsed at the beginning of 2022 but Americans can nevertheless claim the additional money if they didnt obtain it last year. But patience is needed. Department of the Treasury are ending out the.

Child Tax Credit payments continue to be distributed across the United States in a bid to ease the financial burden caused by COVID-19 with November 15 the next date on.

Parents Have Just Days Left To Boost Or Opt Out Of December Child Tax Credit Payment Here S How The Us Sun

Most Americans Plan To Put Advanced Child Tax Credit Into Savings

5 Things To Know About Irs Letter 6419 Taxes And The Child Tax Credit

Last Child Tax Credit Payment Amount Explained How Much Will You Get This Week The Us Sun

How To Get The Child Tax Credit Massachusetts Jobs With Justice

2021 Expanded Child Tax Credit Who Qualifies Payment Schedule More Tele Haiti Tele Haiti First Tv Network Home Telehaiti Alpha Planet Haiti Tele Eclair Rtnh Telekiskeya Scoop

Families Can Now Register For Child Tax Credit Payments

Stimulus Update Some Families Will Get 1 800 Child Tax Credit In December Al Com

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

Fact Sheet Advance Child Tax Credit

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

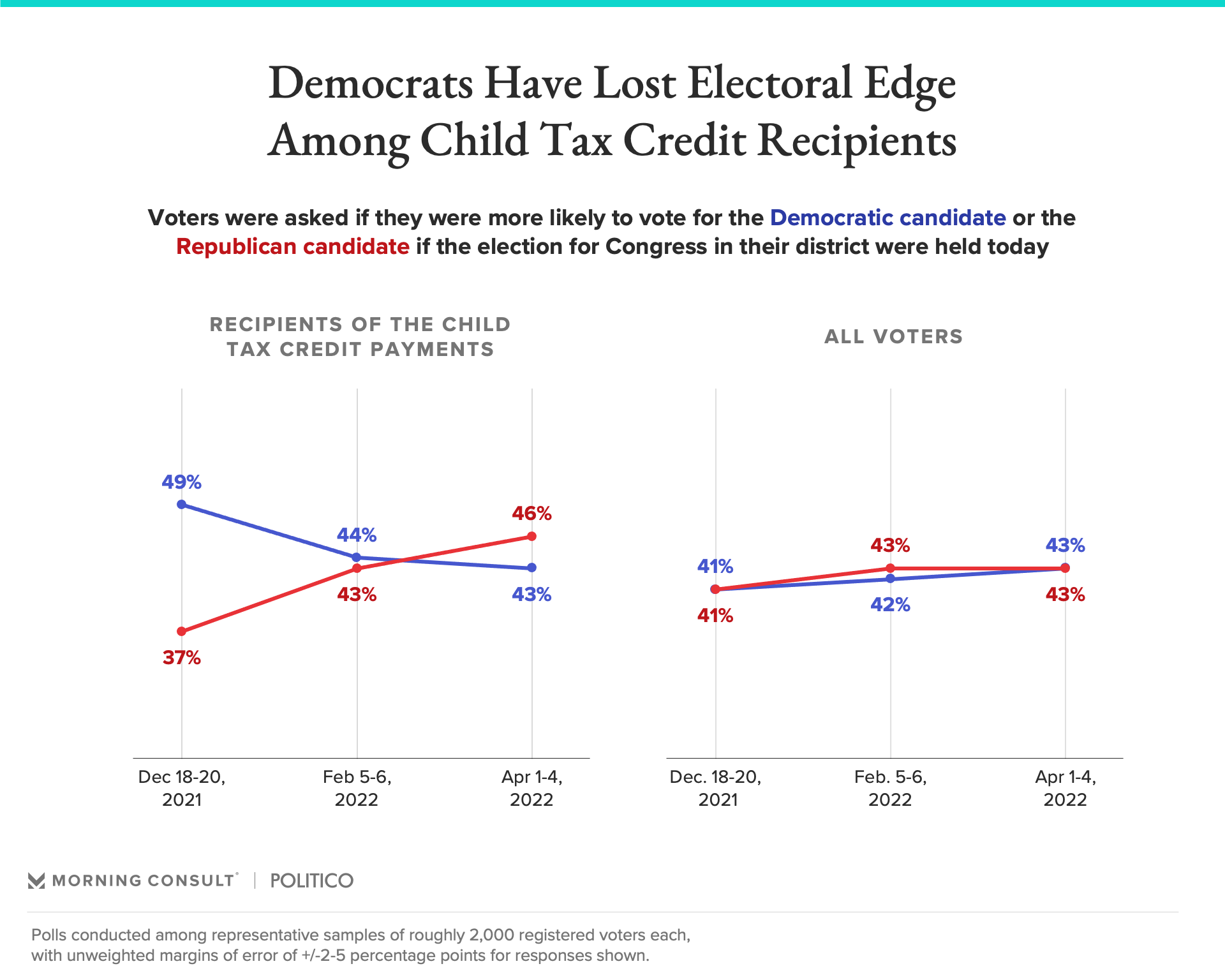

Republicans Favored To Win Senate Among Child Tax Credit Recipients

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Child Tax Credit Update Next Payment Coming On November 15 Marca

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Claim Advance Child Tax Credit On 2021 Return Filing King5 Com