special tax notice empower

402f SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. It is not intended as tax advice.

Kucoin Labs Launches 100 Million Metaverse Fund To Empower Early Stage Metaverse Projects Business Wire

This Special Tax Notice Applies to Distributions from Governmental 457b Plans This notice contains important information you will need before you decide how to receive Plan benefits.

. Empower Representative Compensation. Convey information needed before deciding how to receive plan benefits. FA 403B Special Tax Notice Form.

The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. AccuCustomizationmetaTagsdescription logon authenticationerrorMessage translateauthenticationerrorMessageParams logonlogonTitle translate. While the Tax Code allows plans to create their.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan. Tools will provide different results based on the operational aspects of the tool. This notice explains how you can continue to defer federal income tax on your retirement savings in your retirement plan the Plan and contains important information you will need before you decide how to receive your Plan benefits.

This notice is provided to you because all or part of the payment. Termination of Employment of a Retired School Teacher Administrator or School Resource Officer. Retirement Operations OMB No.

Usually it is included along with the distribution form. Special tax notice regarding retirement plan payments your rollover options you are receiving this notice because all or a portion of a payment you are receiving from the_____insert name of plan the plan is eligible to be rolled over to an ira or an employer plan. SPECIAL TAX NOTICE For Payments Not from a Designated Roth Account State Form INSERT FORM NUMBER Indiana Public Retirement System One North Capitol Ave Suite 001 Indianapolis IN 46204 Page 1 of 7 Special Tax Notice.

The statements contained in this notice prepared by the Office of Personnel Management OPM are based upon a review of Internal Revenue Service IRS publications specifically Publications 575 Pension and Annuity. 1 These documents include additional text from Notice 402f the Special Tax Notice Regarding Plan Payments. Our goal is to.

Special Tax Notice Regarding Rollovers. Assignment of 401欀尩 Plan account prohibited 31. Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options You are receiving this notice because all or a portion of a payment you are receiving from the_____INSERT NAME OF PLAN the Plan is eligible to be rolled over to an IRA or an employer plan.

Empower and Enable All Taxpayers to Meet Their Tax Obligations. SECTION 1 - 402f NOTICE. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan.

The Savings Planner is for informational purposes only and not intended to provide investment legal or tax recommendations or advice. Rollover Option The payment is made directly to an IRA or employer plan. For Payments Not from a Designated Roth Account Effective.

You may voluntarily elect to have additional withholding below. Special Tax Notice to Plan Participants Regarding Payments from Qualified Plans from the Plan Administrator or the participant website. Special tax notice regarding plan payments.

We continue to add and enhance tools and support to improve taxpayers and tax professionals interactions with the IRS on whichever channel they prefer. The Empower Participant Experience and the Retirement Planner are separate tools and do not share data between each other. Withdrawals eligible for rollover 30.

Early withdrawal penalty 30. 20 YOUR ROLLOVER OPTIONS. Special Tax Notice Contact information.

Special Tax Notice and tax reporting 31. As an employee of JPMorgan Chase you have the opportunity to participate in the JPMorgan Chase 401k Savings Plan one of the best ways for you to prepare for your retirement. No income tax is withheld from your transfer amount.

The Default Investment Notice outlines your rights if you have not chosen funds but are making contributions to the Plan. If you also receive a payment from a designated Roth. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account a type of account with special tax rules in some employer plans.

That means the Notice doesnt have to be provided until the participant elects a distribution. Tax treatment of contribution types 29. We will empower taxpayers by making it easier for them to understand and meet their filing reporting and payment obligations.

The Special Tax Notice Regarding Plan Payments explains the tax consequences of taking a distribution from your Plan. Office of Personnel Management Form Approved. Voluntary Employer Sick Leave Submission.

It explains when and how you can continue to defer federal income tax on your retirement savings when you receive a distribution. Explain how to defer federal income tax on 403 b savings. IRA or an employer plan.

This notice is provided to you by. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. This Special Tax Notice brochure is provided for your convenience only.

A9164_402f Notice 0321 3 W The exception for payments made at least annually in equal or nearly equal amounts over a specified period applies without regard to whether you have had a separation from service. This notice is intended to help you decide whether to do such a rollover. Power of attorney conservatorship and guardianship 31.

MPERS recommends that you consult a tax professional before making your payment election. Download and use the empower retirement app available on both. Special Tax Notice Regarding Plan Payments.

Net unrealized appreciation 29. 401k Savings Plan Enrollment Guide. DC-4253-1105 Page 1 of 4.

This disclosure describes compensation practices for Empower Retirement LLC Empower employees who interact with individual investors such as investors in retirement plans recordkept by Empower or investors in individual retirement or brokerage accounts offered through Empower or its affiliates. This notice is intended to help you decide. Participants complete the top portion of the form Participant Information along with the reason for payment indicated in the following section.

Qualified domestic relations order 31. Receiving this does not mean you are eligible for a distribution or that you have requested a distribution. Empower Retirement is required to withhold mandatory 20 for federal income taxes on the taxable portion of your benefit distributed to you as a Cash Payment.

Empower Taxpayers Internal Revenue Service

Empower Retirement Closes Acquisition Of Personal Capital Business Wire

Pdf Technology As The Key To Women S Empowerment A Scoping Review

Oracle Perspective Tech Trends 2020 Empowering The Digital Journey With Oracle Deloitte

Unblocked A Revolutionary Approach To Tapping Into Your Chakra Empowerment Energy To Reclaim Your Passion Joy And Confidence Amazon Co Uk Lynch Raniere Margaret Raniere Ph D David 9781401961442 Books

Litera To Acquire Prosperoware To Empower Team Collaboration Across Systems Business Wire

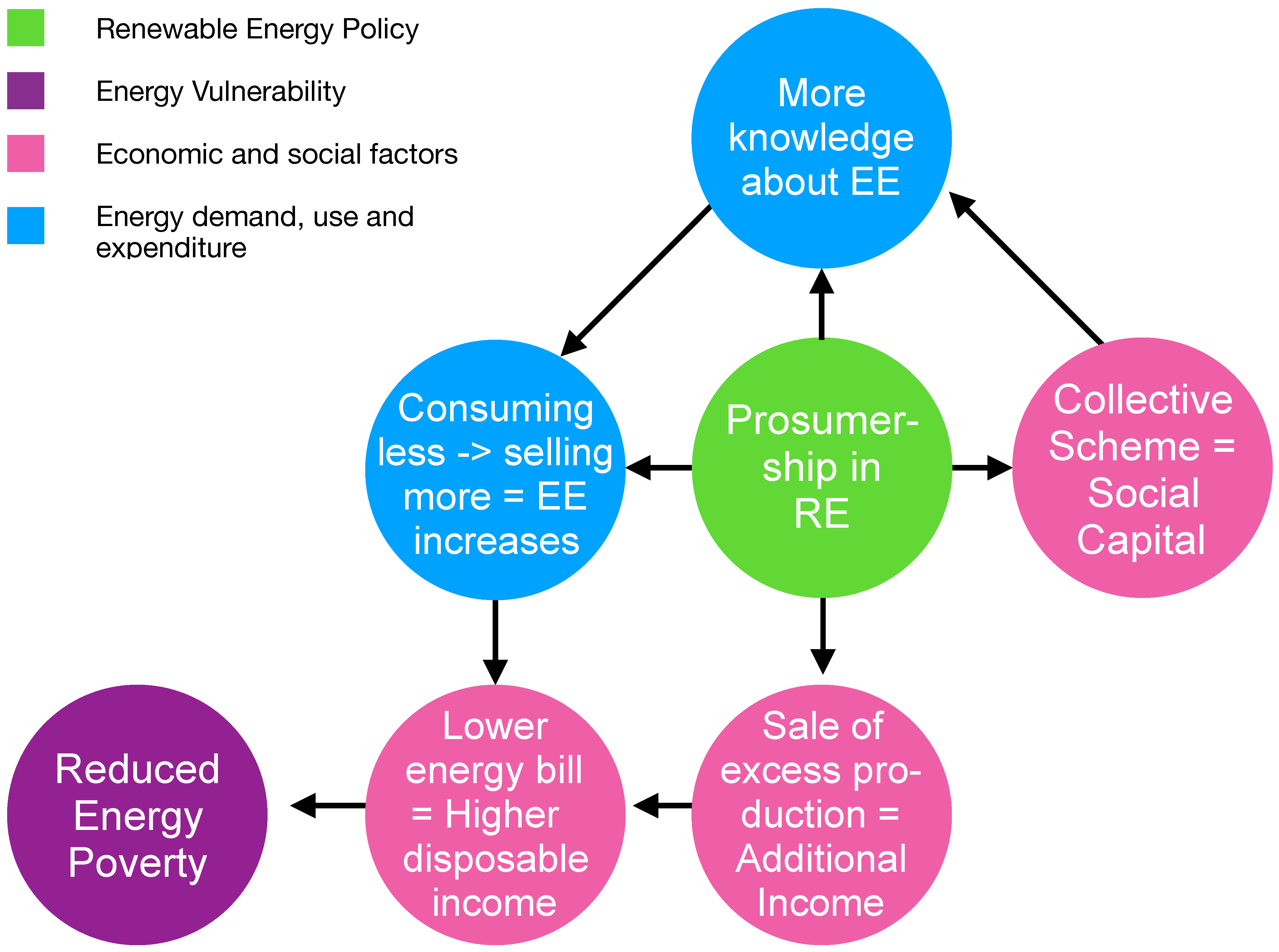

Energies Free Full Text Empowering Vulnerable Consumers To Join Renewable Energy Communities Towards An Inclusive Design Of The Clean Energy Package Html

Empower Physical Therapy Adds 6 California Locations Business Wire

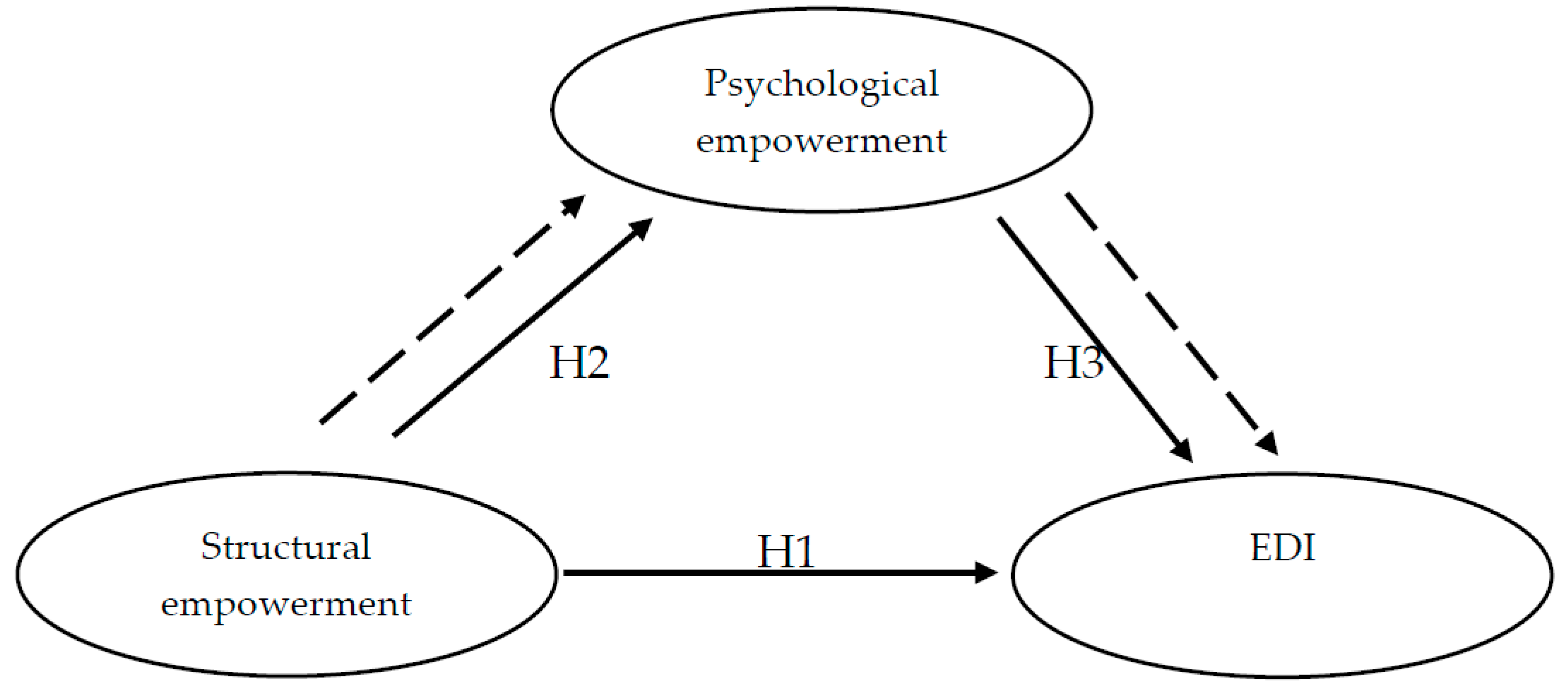

Administrative Sciences Free Full Text Linking Structural Empowerment To Employee Driven Innovation The Mediating Role Of Psychological Empowerment Html

Nearly 90 Of Organisations Say Success Depends On Empowering Frontline Employees To Make Decisions In The Moment According To New Report Business Wire

Pdf Behavior Change Or Empowerment On The Ethics Of Health Promotion Goals

Yas Queen Uplifting Quotes And Statements To Empower And Inspire Amazon Co Uk Publishers Summersdale 9781787835344 Books

The Superhero Brain Explaining Autism To Empower Kids Girl Amazon Co Uk Land Christel 9781979870009 Books

Women In A Patriarchal World Twenty Five Empowering Stories From The Bible Amazon Co Uk Storkey Elaine 9780281084074 Books

Empower Retirement Closes Acquisition Of Personal Capital Business Wire

Yas Queen Uplifting Quotes And Statements To Empower And Inspire Amazon Co Uk Publishers Summersdale 9781787835344 Books

Entrust Empowers Digital Financial Card Issuance With Acquisition Of Antelop Solutions Business Wire

Empower Participants Bolster Retirement Savings Through Pandemic Business Wire

Sales Enablement A Master Framework To Engage Equip And Empower A World Class Sales Force Amazon Co Uk Matthews Byron Schenk Tamara 9781119440277 Books